The 2026 federal income tax rates mark an important update for taxpayers preparing for future filings, as they reflect inflation-based adjustments applied across income brackets, deductions, and related tax thresholds. For the 2026 tax year, the federal income tax system continues to operate with seven marginal tax brackets, ranging from 10 percent to 37 percent, depending on taxable income and filing status. These rates apply to income earned during 2026 and will be reported when taxpayers file returns in the following year. Alongside bracket updates, the standard deduction amounts have also increased, providing relief against inflation and helping taxpayers preserve purchasing power while remaining within the existing tax structure.

Understanding how the 2026 federal income tax brackets work is essential for individuals, families, and financial planners. Each filing status—single, married filing jointly, and head of household—has its own income thresholds, meaning the same income level can be taxed differently depending on how a return is filed. These brackets are designed to ensure a progressive system, where higher portions of income are taxed at higher rates, while lower portions remain subject to lower rates.

In addition to rate changes, several supporting tax provisions have been adjusted for 2026. These include higher standard deductions, revised thresholds for certain credits, and inflation-indexed limits affecting alternative minimum tax calculations. Together, these updates shape how much federal income tax a taxpayer ultimately owes and influence withholding decisions, estimated tax payments, and overall tax planning strategies.

How the Federal Income Tax System Works in 2026

The federal income tax system uses a marginal tax rate structure, meaning income is divided into layers, with each layer taxed at a specific rate. Moving into a higher tax bracket does not mean all income is taxed at that higher rate. Instead, only the portion of income within that bracket is taxed at the corresponding percentage.

This system helps balance fairness and revenue collection while preventing sudden jumps in tax liability when income increases slightly.

2026 Federal Income Tax Brackets by Filing Status

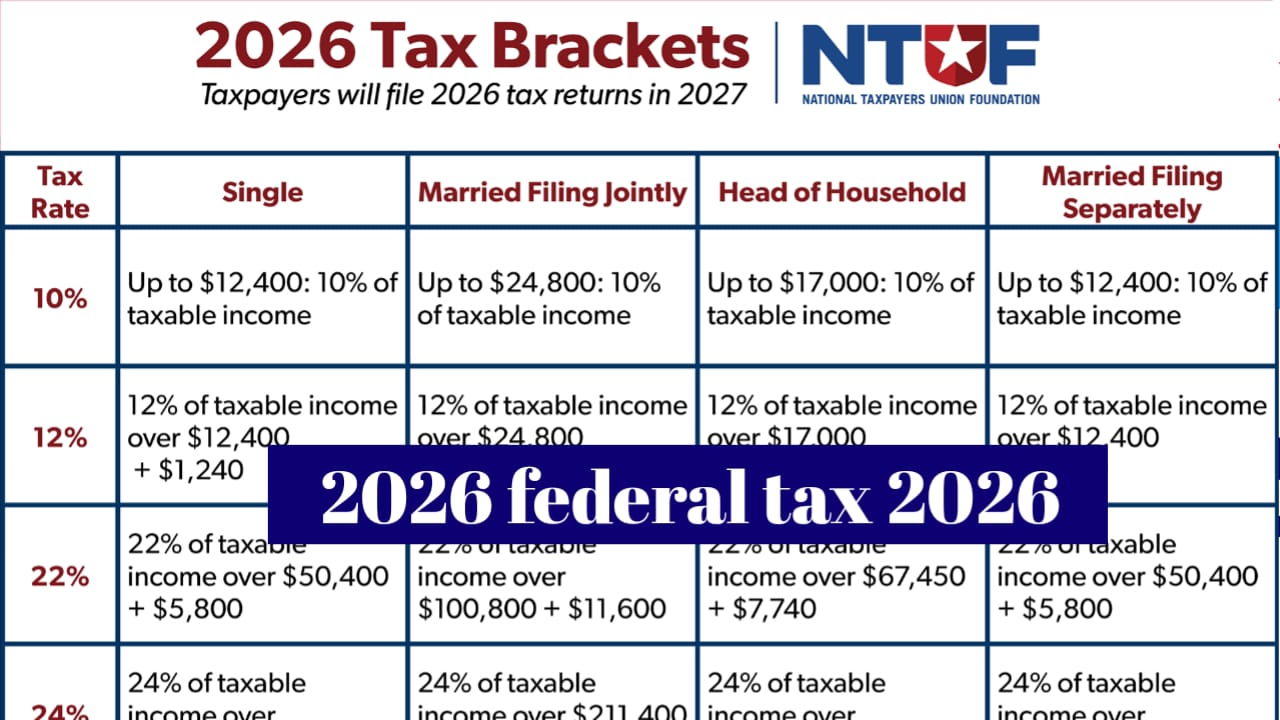

The table below summarizes the 2026 federal income tax rates and income thresholds for major filing categories.

| Tax Rate | Single Filers | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 10% | Up to $12,400 | Up to $24,800 | Up to $17,700 |

| 12% | $12,401 – $50,400 | $24,801 – $100,800 | $17,701 – $67,450 |

| 22% | $50,401 – $105,700 | $100,801 – $211,400 | $67,451 – $105,700 |

| 24% | $105,701 – $201,775 | $211,401 – $403,550 | $105,701 – $201,775 |

| 32% | $201,776 – $256,225 | $403,551 – $512,450 | $201,776 – $256,200 |

| 35% | $256,226 – $640,600 | $512,451 – $768,700 | $256,201 – $640,600 |

| 37% | Over $640,600 | Over $768,700 | Over $640,600 |

ALSO READ-

These brackets apply to taxable income, which is calculated after subtracting deductions and adjustments.

Standard Deduction Amounts for 2026

The standard deduction plays a major role in reducing taxable income for most filers. For 2026, standard deduction amounts have increased in line with inflation:

-

Single filers: $16,100

-

Married filing jointly: $32,200

-

Head of household: $24,150

Personal exemptions remain set at zero, continuing the policy established in earlier tax reforms. Most taxpayers benefit from the higher standard deduction rather than itemizing deductions.

What Changed From the Previous Year

Compared to the prior tax year, the 2026 updates mainly reflect inflation adjustments rather than structural tax reform. Income thresholds for each bracket increased slightly, allowing taxpayers to earn more before moving into a higher marginal rate.

Key changes include:

-

Higher bracket income limits

-

Increased standard deductions

-

Inflation-indexed adjustments to related tax provisions

These changes are designed to prevent taxpayers from paying more tax solely due to rising wages caused by inflation.

How 2026 Tax Rates Affect Tax Planning

The 2026 federal income tax rates influence decisions throughout the year, not just at filing time. Understanding your marginal rate helps with estimating tax liability, adjusting paycheck withholding, and planning retirement contributions.

Two important planning considerations include:

-

Timing income and deductions to stay within a favorable bracket

-

Using pre-tax contributions to lower taxable income

Proactive planning can help reduce overall tax liability and avoid surprises at filing time.

Federal Tax Brackets vs. Effective Tax Rate

While marginal tax rates define how income is taxed in segments, the effective tax rate represents the average rate paid on total taxable income. Because income is spread across multiple brackets, most taxpayers pay an effective rate lower than their highest marginal bracket.

This distinction is important when comparing tax burdens or evaluating the real impact of income increases.

Frequently Asked Questions

What is the highest federal income tax rate for 2026?

The top marginal tax rate for 2026 remains 37 percent for higher-income taxpayers.

Do tax brackets change every year?

Yes, federal income tax brackets are typically adjusted annually to account for inflation.

Is the standard deduction higher in 2026?

Yes, the standard deduction increased for all filing statuses in 2026.

Conclusion

The 2026 federal income tax rates maintain the familiar seven-bracket structure while adjusting income thresholds and deductions to reflect inflation. With higher standard deductions and expanded bracket ranges, many taxpayers may see modest relief despite rising incomes. Understanding how these rates apply to your filing status and taxable income is essential for accurate planning and compliance. By staying informed about bracket thresholds, deductions, and marginal versus effective tax rates, taxpayers can make better financial decisions and approach the 2026 tax year with confidence.